Travel insurance ensures a worry-free journey. It ensures financial protection in case of medical emergencies abroad and also helps in the event of flight cancellation, loss of baggage, and passport among other benefits

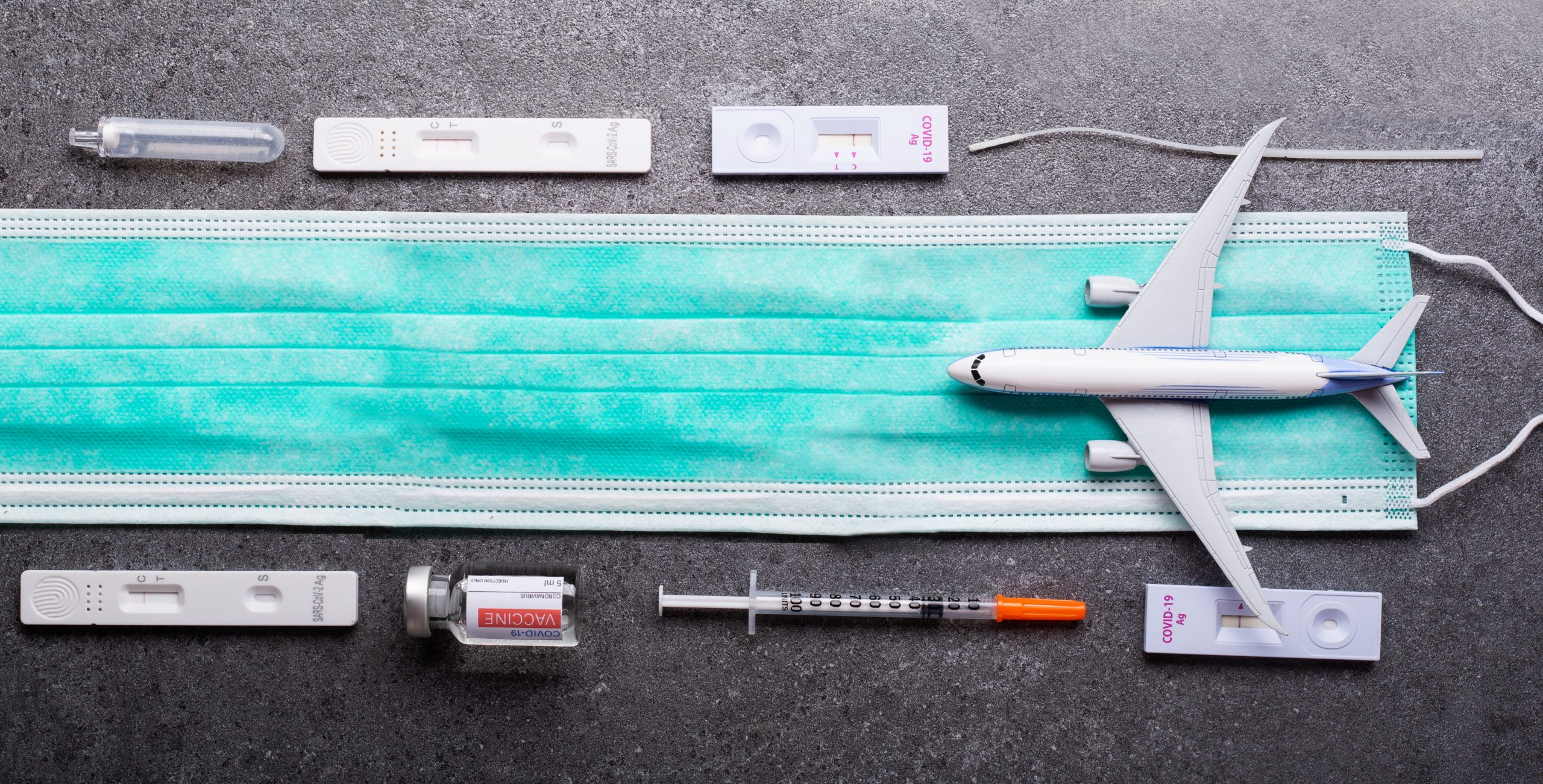

However, we now live in a global pandemic and traveling always carries the risk of infection. Treatment costs for extreme cases of Covid-19 are towards the higher side globally. This is why your travel insurance needs to include coverage against Covid-19 as well.

The best insurance policy is operative 24-hours a day worldwide, providing you optimum protection in all emergencies.

Below are a few pointers on how Covid-19 benefits in travel insurance can work.

COVID-19 Protection in Travel Insurance

The top insurance partner in Kuwait offers up to $35,000 coverage for medical evacuation and repatriation if you get infected with COVID-19, and up to $20,000 for specific destination countries like the US, Canada, and Australia.

Seeking immediate care is crucial since Covid treatment can be time-sensitive in severe cases. The insured person can also be evacuated to the nearest healthcare facility in times of emergency without having to worry about the costs. The insurance shall cover emergency medical expenses and hospitalisation costs incurred abroad due to Covid.

Opt for an insurance policy that provides for expenses for compassionate visits and repatriation of a minor child if the insured has been hospitalized for more than 48 hours.

There are many benefits of having Covid-19 protection, most of all a stress-free travel. Ensure to know the process of filing a claim for Covid-19 related expenses. This includes the validity period of the RT-PCR report and any other exclusions that might be involved. For instance, the insurance might not cover travel to countries against which the government has issued a formal travel advisory.

Remember the insurance cover is valid only for air travel and for residents/citizens of Kuwait. Claim within 48 hours through designated helpline number on your policy document. All the related documents are to be submitted by the beneficiary within 4 months maximum.

Facebook

Facebook twitter

twitter Instagram

Instagram LinkedIn

LinkedIn Youtube

Youtube